Dozer Rental in Tuscaloosa AL: Reputable and Cost Effective Heavy Machinery

Dozer Rental in Tuscaloosa AL: Reputable and Cost Effective Heavy Machinery

Blog Article

Exploring the Financial Advantages of Leasing Construction Devices Contrasted to Possessing It Long-Term

The decision in between owning and leasing building equipment is crucial for monetary management in the sector. Leasing offers instant expense financial savings and operational adaptability, permitting firms to allot resources more successfully. Comprehending these nuances is essential, specifically when considering just how they straighten with certain project demands and monetary methods.

Price Contrast: Leasing Vs. Owning

When reviewing the economic ramifications of having versus renting building and construction devices, an extensive expense comparison is essential for making educated decisions. The selection between renting out and having can significantly affect a company's lower line, and comprehending the linked expenses is crucial.

Renting building devices commonly involves lower in advance prices, enabling businesses to assign funding to other functional demands. Rental costs can build up over time, potentially exceeding the cost of possession if tools is required for an extensive duration.

Alternatively, owning construction devices calls for a substantial initial investment, along with ongoing costs such as funding, devaluation, and insurance policy. While ownership can result in long-term savings, it also locks up funding and may not offer the same degree of adaptability as leasing. Furthermore, owning equipment demands a dedication to its usage, which may not constantly line up with project needs.

Inevitably, the choice to have or rent needs to be based on an extensive analysis of details project demands, monetary capacity, and lasting calculated goals.

Upkeep Duties and costs

The option between owning and renting building and construction tools not just includes financial factors to consider yet likewise encompasses ongoing maintenance expenditures and obligations. Having equipment calls for a considerable commitment to its maintenance, that includes routine inspections, fixings, and prospective upgrades. These responsibilities can swiftly build up, causing unforeseen prices that can stress a budget.

On the other hand, when renting out devices, upkeep is commonly the duty of the rental business. This setup allows professionals to stay clear of the monetary burden connected with wear and tear, along with the logistical difficulties of organizing repairs. Rental arrangements typically consist of provisions for upkeep, implying that service providers can focus on finishing projects rather than stressing over tools condition.

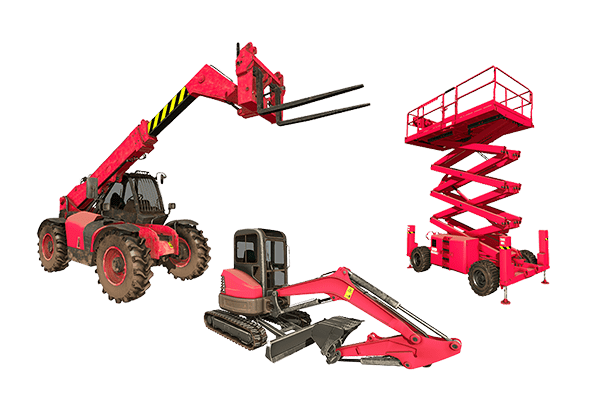

Additionally, the diverse variety of tools offered for rent makes it possible for companies to select the most recent models with innovative modern technology, which can enhance effectiveness and productivity - scissor lift rental in Tuscaloosa Al. By opting for rentals, businesses can avoid the long-lasting responsibility of equipment depreciation and the connected maintenance frustrations. Inevitably, evaluating maintenance costs and duties is essential for making a notified choice concerning whether to have or lease building and construction equipment, considerably affecting general job expenses and functional performance

Depreciation Influence On Possession

A significant element to consider in the choice to have building devices is the effect of devaluation on total possession prices. Devaluation stands for the decline in value of the equipment in time, influenced by elements such as usage, deterioration, and improvements in innovation. As devices ages, its market worth reduces, which can dramatically influence the owner's financial placement when it comes time to market or trade the tools.

For building companies, this devaluation can equate to substantial losses if the tools is not used to its max possibility or if it lapses. Proprietors should account for devaluation in their financial forecasts, which can result in greater general prices compared to renting out. Furthermore, the tax obligation ramifications of devaluation can be complicated; while it might offer some tax obligation benefits, these are often balanced out Read Full Article by the fact of minimized resale worth.

Eventually, the worry of depreciation stresses the importance of recognizing the long-term monetary dedication associated with having construction devices. Firms must meticulously assess just how frequently they will certainly make use of the equipment and the prospective economic impact of depreciation to make an enlightened decision about possession versus renting out.

Financial Flexibility of Leasing

Renting out construction equipment provides considerable economic flexibility, allowing business to designate sources more efficiently. This adaptability is especially vital in a sector characterized by fluctuating project demands and varying workloads. By choosing to lease, services can stay clear of the significant resources expense needed for acquiring tools, maintaining cash flow for other functional demands.

In addition, renting out tools makes it possible for firms to customize their tools selections to details job demands without the long-lasting commitment related to ownership. This means that businesses can easily scale their equipment supply up or down based upon anticipated and current project demands. Subsequently, this adaptability minimizes the danger of over-investment in machinery that might come to be underutilized or outdated in time.

Another economic benefit of renting is the potential for tax obligation advantages. Rental payments are frequently considered general expenses, enabling instant tax reductions, unlike devaluation on owned tools, which is topped several years. scissor lift rental additional resources in Tuscaloosa Al. This prompt cost recognition can better enhance a company's cash money position

Long-Term Task Considerations

When assessing the lasting demands of a construction service, the choice in between having and leasing devices comes to be extra complex. For projects with extended timelines, buying devices may appear helpful due to the possibility for reduced total prices.

The construction industry is advancing swiftly, with brand-new devices offering enhanced efficiency and security features. This adaptability is especially helpful for services that manage diverse projects requiring various kinds of devices.

Moreover, monetary security plays a crucial role. Possessing tools commonly entails significant capital financial investment and devaluation worries, while renting permits even more predictable budgeting and capital. Ultimately, the choice in between leasing and having ought to be aligned with the critical goals of the construction organization, considering both expected and existing project needs.

Final Thought

Finally, renting out building tools provides significant financial benefits over long-term possession. The decreased in advance prices, elimination of upkeep responsibilities, and evasion of devaluation contribute to improved cash money flow and monetary adaptability. scissor lift rental in Tuscaloosa Al. Furthermore, rental repayments work as instant tax obligation deductions, even more benefiting contractors. Eventually, the decision to lease as opposed to very own aligns with the vibrant nature of construction projects, permitting adaptability and access to the newest devices without the financial worries connected with ownership.

As equipment this website ages, its market value diminishes, which can considerably affect the owner's financial position when it comes time to trade the tools or offer.

Leasing building equipment offers significant economic adaptability, enabling business to assign resources more efficiently.In addition, leasing equipment makes it possible for business to customize their devices choices to details task requirements without the long-term dedication connected with possession.In verdict, leasing construction tools uses substantial economic benefits over long-lasting possession. Eventually, the choice to lease instead than own aligns with the dynamic nature of building projects, enabling for adaptability and accessibility to the latest devices without the financial burdens connected with possession.

Report this page